Key Cyber Threats Facing the Financial Sector in 2025

The banking industry faces increasing challenges from cybercriminals targeting sensitive data and financial assets. Understanding cyber threats in the banking industry is crucial for effective security.

Published July 1, 2025

Cyber threats in the financial sector are rapidly evolving, posing significant risks to institutions and their customers. The cyber security threats in banking are becoming increasingly sophisticated, with cybercriminals finding new ways to exploit vulnerabilities. Banking cyber threats are particularly concerning, as they can result in data breaches, financial losses, and severe reputational damage. Addressing these cyber threats in the financial sector requires proactive measures, continuous monitoring, and a strong security infrastructure to defend against these complex risks.

In this blog, we will look at common cyber threats targeting the financial sector and discuss how to effectively mitigate these risks.

» Looking for an effective solution? KELA provides the comprehensive support you need

Top 4 Reasons the Financial Sector Is a Prime Target for Cybersecurity Threats

1. Direct Financial Gain

This aspect is acknowledged as the most apparent reason. Vast sums of money are handled by financial institutions, which facilitate transactions and store valuable financial assets. Money can be directly stolen by cybercriminals through various methods, including the following:

- Access to customer accounts can be gained by attackers, allowing funds to be transferred.

- Systems can be manipulated by criminals to perform unauthorized transactions.

- Stolen financial data, such as credit card numbers, can be utilized for fraudulent purchases or sold on the dark web.

2. Highly Sensitive Data Is Valuable to Cybercriminals

A wealth of highly sensitive data is possessed by financial institutions, which is deemed valuable to criminals. This includes:

- Personally Identifiable Information (PII): Names, addresses, social security numbers, dates of birth, etc., can be exploited for identity theft.

- Financial account details: Information including account numbers, credit card numbers, and transaction history can enable direct financial theft.

- Authentication credentials: Usernames, passwords, and PINs can provide unauthorized access to accounts and systems.

» Make sure you understand the difference between leaked credentials and compromised accounts

3. Systemic Impact

Successful attacks on financial institutions can result in widespread consequences that extend beyond individual victims, including:

- Loss of trust: Public confidence in the financial system can be eroded by breaches.

- Disruption of services: Essential financial services may be disrupted by attacks, leading to economic damage.

- Cascading effects: Problems experienced by one institution can potentially impact others.

4. Regulatory Pressure

The financial industry is heavily regulated, and breaches can lead to significant fines and penalties, increasing the pressure on institutions to safeguard their systems. While this pressure aims to enhance security, it can also render them targets for extortion.

Types of data or systems that are most at risk include:

- Customer account databases

- Online banking platforms

- Payment processing systems

- Core banking systems

- ATMs and POS systems

- Communication networks

- Employee workstations

» Here are the most targeted entry points by hackers

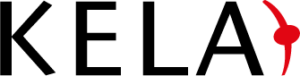

6 Cyber Threats Facing the Financial Sector

1. Ransomware Attacks

Ransomware is a type of malicious software that encrypts a victim's data, rendering systems inaccessible. Attackers demand a ransom, typically in cryptocurrency, in exchange for the decryption key. It is considered one of the major cybersecurity threats to the financial sector due to its potential for significant disruption and financial loss.

Techniques Used by Attackers

- Phishing emails

- Exploited vulnerabilities (like unpatched software)

- Compromised credentials

» Learn how to prevent phishing attacks before they catch you

» Did you know? Ransomware groups are selling network access directly

Main Targets of Ransomware Attacks

- While all financial institutions are targets, large banks and credit unions are often singled out due to their perceived ability to pay large ransoms.

- Smaller institutions like community banks and credit unions are increasingly hit as they may have fewer resources for robust defenses.

- Fintech businesses can also be targeted for their valuable intellectual property or customer data.

Impact of Ransomware Attacks on the Financial Sector

Financial impact

Ransomware attacks can lead to major financial losses through ransom payments (if made), costly recovery efforts including IT forensics, system restoration, and security upgrades, as well as regulatory fines for data breaches and mounting legal fees.

Operational disruption

Ransomware can halt critical functions such as customer transactions, loan processing, and internal operations for days or even weeks—resulting in revenue loss, erosion of customer trust, and lasting damage to brand reputation.

» See our complete guide to combating ransomware

2. APTs

Advanced Persistent Threats (APTs) involve sophisticated, stealthy, and prolonged attacks, often orchestrated by nation-states or state-sponsored groups. Their goal is typically espionage (stealing sensitive government or corporate data, intellectual property, etc.), financial theft on a large scale (like the Lazarus Group heists), or disruption of critical infrastructure.

Techniques Used by Attackers

- Highly targeted spear-phishing

- Zero-day exploits

- Supply chain attacks

Main Targets of APTs

- Large multinational banks, central banks, stock exchanges, and institutions involved in international finance (i.e. SWIFT) are prime targets for espionage or large-scale theft.

- Investment firms holding valuable market strategies or M&A data are also targets. Nation-states target these entities for geopolitical leverage, economic advantage, or funding illicit activities.

Impact of APTs on the Financial Sector

Financial and operational impact

Financial losses can reach billions, as seen in major cryptocurrency heists. Operational disruption may destabilize markets or critical payment systems, affecting global economic stability.

Reputational damage

Reputational damage can be immense, potentially eroding public and institutional confidence in the stability and integrity of the targeted financial entity.

3. Supply Chain Attacks

Supply chain attacks involve compromising a trusted third-party vendor or software provider to gain access to their downstream clients, such as financial institutions, posing significant cybersecurity threats to the financial sector.

Techniques Used by Attackers

- Attackers might inject malicious code into software updates or compromise a vendor's network to steal credentials granting access to client systems.

- Attackers can also intercept communication between the financial institution and its vendors. By positioning themselves in the communication path, they can eavesdrop on sensitive information, steal credentials, or even manipulate data being exchanged.

- A vulnerability in a payment gateway's API could allow attackers to bypass security controls and initiate fraudulent transactions.

Main Targets of Supply Chain Attacks

- All financial organizations relying on third-party software or services are potential victims.

- This includes retail banks using common core banking platforms, investment firms using specialized trading software, fintech companies integrating third-party APIs, and credit unions using external IT service providers

Impact of Supply Chain Attacks on the Financial Sector

Financial impact

Financial losses arise from incident response efforts, potential data breaches impacting many clients, and reputational damage by association.

Reputational impact

The scale of such attacks can be massive, as demonstrated by incidents exploiting widely used software like MOVEit Transfer. These attacks can cause extensive damage to many organizations at once, undermining confidence in both the affected institutions and their associated vendors.

4. Mobile Banking Malware

Mobile banking malware involves malicious software specifically targeting mobile devices to compromise banking applications or intercept financial information.

Techniques Used by Attackers

- Overlay attacks: Displaying fake login screens over legitimate banking apps.

- Keylogging: Recording user input.

- SMS interception: Stealing one-time passwords sent via text.

- Distributing malware: This happens via fake apps, phishing links, or compromised websites.

Main Targets of Mobile Banking Malware

- Customer base accessed via mobile platforms: The customer base is a primary target, as attackers aim to compromise end-user accounts to initiate fraudulent transactions, steal credentials for resale, or gather personal data.

- Retail banks, credit unions, and fintech companies offering mobile apps: These institutions are prime targets due to their large customer bases, which offer many potential victims.

Impact of Mobile Banking Malware on the Financial Sector

Financial loss

While individual fraudulent transactions might be small, the cumulative financial loss across many compromised customer accounts can be significant.

Reputational impact

If an institution's app is perceived as insecure, it can lead to a loss of customer trust, causing them to switch providers.

Operational impact

Financial institutions may face increased fraud claims, the need to reissue credentials, and potential updates or temporary disabling of vulnerable mobile app features to address security flaws.

» Learn more: How to reduce damage from info-stealing malware

5. Cloud Misconfigurations

Cloud misconfigurations refer to the improper setup of security settings within a cloud environment that can expose sensitive data or allow unauthorized access to critical infrastructure.

Techniques Used by Attackers

- Unsecured storage buckets (e.g., AWS S3): Exposing sensitive data due to improper permissions on cloud storage.

- Unpatched cloud workloads: Attacks targeting vulnerabilities in unpatched or outdated cloud-based applications.

- Insecure APIs: Weaknesses in APIs that connect cloud services with other platforms, allowing unauthorized access.

» Make sure you understand how threat actors breach and exploit your data

Main Targets of Cloud Misconfigurations

- Any financial organization using cloud services is potentially vulnerable, from large banks leveraging multi-cloud strategies to fintech startups built entirely on the cloud.

- Organizations undergoing rapid cloud migration or lacking specialized cloud security expertise are particularly at risk.

Impact of Cloud Misconfigurations on the Financial Sector

Data breaches

Massive data breaches involving sensitive customer or financial data can occur, leading to severe regulatory fines (e.g., under GDPR or CCPA) and reputational damage.

Disruption of critical services

While less likely to cause immediate shutdowns like ransomware, misconfigurations can disrupt key business processes, affecting customer experience and internal operations.

6. AI-Powered Cybersecurity Threats

AI-powered cybersecurity threats in the financial sector refer to cyberattacks that leverage artificial intelligence to enhance the effectiveness of malicious activities.

Techniques Used by Attackers

- Deepfake impersonation: Cybercriminals use AI-generated deepfake audio or video to impersonate executives or trusted individuals, manipulating targets into making fraudulent transactions or revealing sensitive data.

- AI-powered phishing: AI automates the creation of highly convincing, personalized phishing emails that are context-aware, making them harder to detect and increasing the likelihood of victims falling for scams.

- Automated vulnerability scanning: AI-powered tools can scan systems for vulnerabilities, adapting malware to evade detection and enhance the effectiveness of attacks.

» Learn more: How scary is that data leak, really?

Main Targets of AI-Powered Cybersecurity Threats

- Large banks and investment firms: These institutions are particularly vulnerable to sophisticated deepfake fraud targeting high-value transactions or financial schemes, as well as AI-driven social engineering efforts aimed at manipulating executives.

- Retail banks and credit unions: AI-enhanced phishing campaigns target both employees and customers, aiming to steal credentials, install malware, or gain unauthorized access to sensitive financial data.

- Fintech companies: often using newer and less-tested codebases, are at risk of AI-driven vulnerability scanning designed to identify and exploit weaknesses in their systems.

Impact of AI-Powered Cybersecurity Threats on the Financial Sector

Financial losses

Fraudulent transactions resulting from AI-driven deepfake impersonation can lead to significant financial losses, especially if high-value transfers are involved.

Credential compromise

Repeated successful phishing attacks enable attackers to steal login credentials, which can then be used to launch more advanced attacks like ransomware.

Reputational impact

Successful AI-driven attacks erode customer trust in digital channels, leading to reputational damage and forcing institutions to overhaul security measures, awareness programs, and authentication processes.

Pro Tip: To stay ahead of cyber threats in the financial industry, focus on three key areas:

- Regularly improve your systems

- Train users to spot social engineering tactics

- Actively gather threat intelligence to anticipate potential attacks.

These steps are essential for reducing risks in an ever-changing security landscape.

» Read more: How cybercriminals exploit the power of generative AI

Past Cyber Incidents: Lessons for Financial Organizations in 2026

1. Equifax Data Breach (2017)

In one of the largest data breaches in history, Equifax, a credit reporting agency, exposed the sensitive personal information of over 145 million individuals.

The breach resulted from an unpatched vulnerability in the Apache Struts web application framework, which Equifax had failed to address despite a patch being available for several months.

Key lessons from the Equifax data breach:

- Maintain up-to-date software and apply patches for known vulnerabilities without delay.

- Implement proactive vulnerability management programs to stay ahead of potential threats.

- Ensure proper security certificates are in place to protect data integrity.

- Focus on network segmentation to contain the spread of breaches within an organization.

- Neglecting basic cybersecurity practices can lead to catastrophic breaches and reputational damage.

- Failure to address vulnerabilities can result in significant financial losses and operational disruptions.

» Did you know? Ransomware groups are now selling network access directly

2. ICBC Ransomware Attack (2023)

In 2023, a ransomware attack targeted the Industrial and Commercial Bank of China’s (ICBC) U.S. financial services division. The attack led to major disruptions in the U.S. Treasury market, causing financial instability.

One of the key factors contributing to the breach was the bank's reliance on insecure communication channels, such as personal email accounts (Gmail) and USB drives, which were used for sensitive communication and trading when the bank’s corporate systems went down.

Key lessons from the ICBC ransomware attack:

- The ICBC attack highlights the systemic risk posed by cyber incidents, emphasizing the need for robust operational resilience.

- Financial institutions should implement and regularly test incident response plans to ensure they are prepared for disruptions.

- Backup communication systems and operational procedures must be secure and able to function independently if primary systems fail.

- A single point of weakness, such as reliance on insecure methods like personal email or USB drives, can jeopardize the entire network.

» Not convinced? Here are the reasons you need cyber threat intelligence

Cyber Security Threats to the Financial Sector: How KELA Supports You

KELA provides financial institutions with actionable cybercrime threat intelligence from the dark web and restricted channels. We track finance sector cyber attacks targeting your brand, infrastructure, employees, and customers, identifying leaked credentials, network access offerings, and mentions in cybercriminal discussions.

Our early warnings and contextual intelligence help you proactively address risks and strengthen your defenses, allowing you to stay ahead of emerging cyber security threats in the financial sector.

» Ready to begin? Contact us to learn more or try KELA for free